Corporate Finance

Ord Minnett Corporate Finance provides clients with best-in-class service across the spectrum of capital market financing, mergers and acquisitions, and aftermarket support

Expertise

A PROUD HERITAGE OF EXCELLENCE

Ord Minnett Corporate Finance executives have many years of global investment banking and commercial experience. In putting together a team for a particular assignment we are able to draw on a variety of professional backgrounds, including finance, engineering, law, accounting, retail, agriculture and management consulting.

Capabilities

Ord Minnett Corporate Finance provides clients with best-in-class service across the spectrum of capital market financing, mergers & acquisitions and aftermarket support.

Specialisation in underwriting and advising companies that are seeking to raise capital.

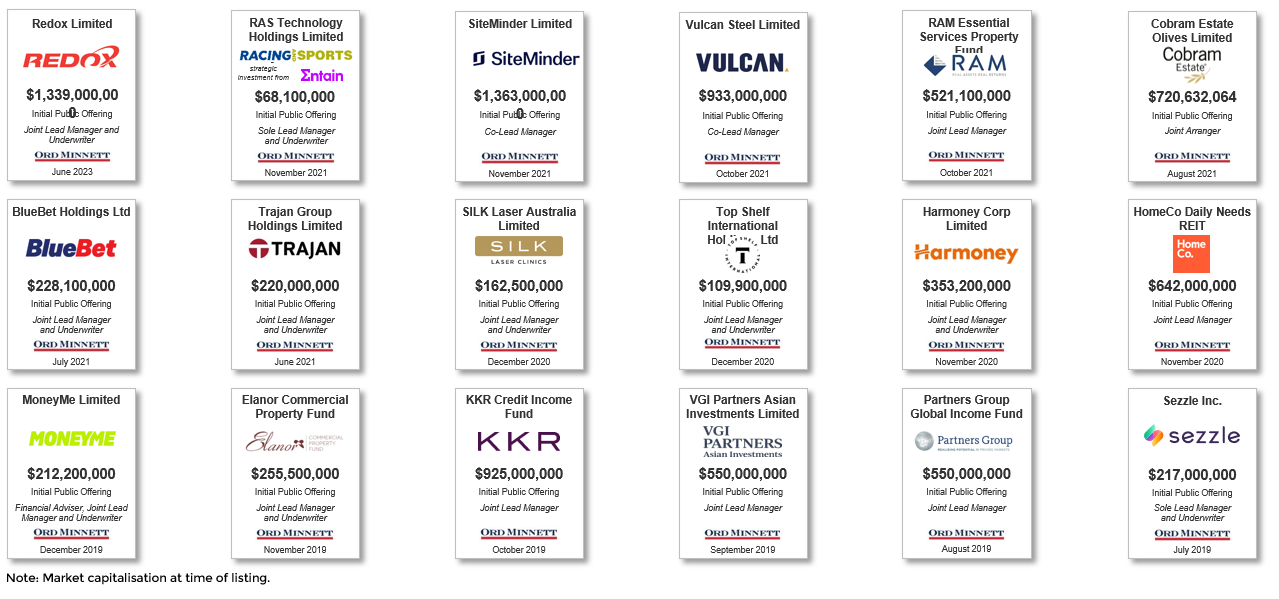

- ASX IPO

- Pre-IPOs

- Secondary raisings for listed companies (institutional placements, share purchase plans, entitlement offers, selldowns and block trades)

- Unlisted growth capital

Equity and equity-linked security issuance capabilities (convertible notes).

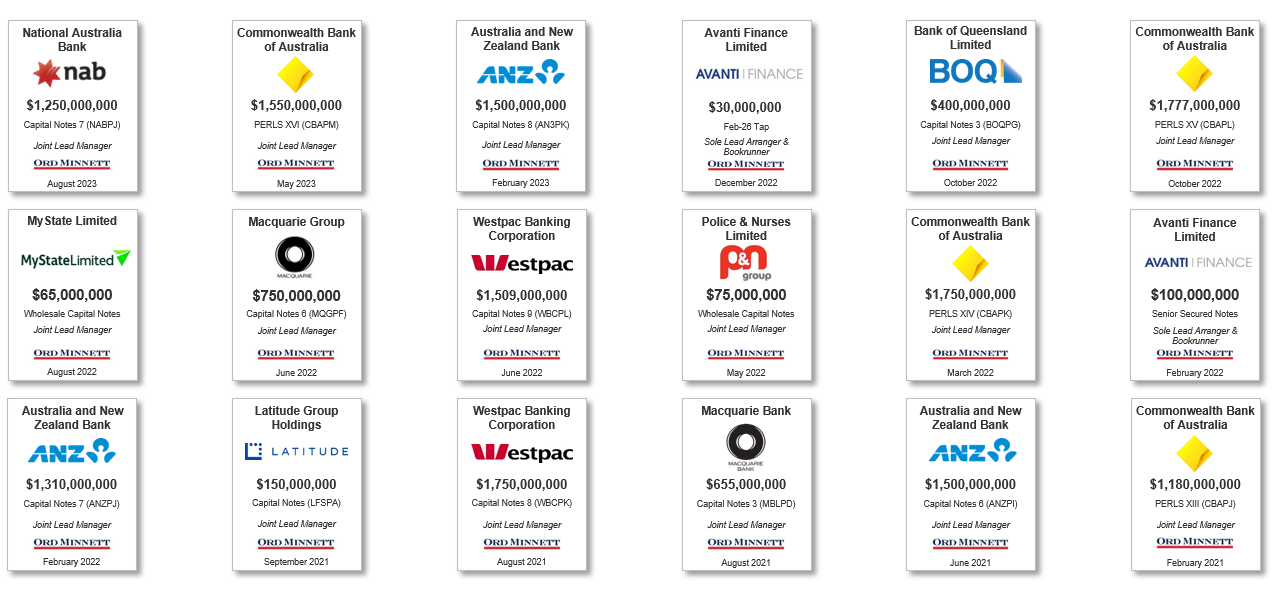

Fixed income / hybrid capital (convertible preference shares, subordinated notes and capital notes) origination, structuring, execution and distribution.

Advisory and evaluation of capital requirements:

- Optimal capital structure analysis

- Review of funding options

- Execution of capital management strategies

- Negotiation with senior and junior lenders

Corporate strategy development, and assistance in the development of business plans, industry analysis, competitive positioning and shareholder communication strategies.

Investor identification, engagement and education – including strategic investors.

Board structuring advice and proprietary executive & non-executive Director candidate database.

- Merger & acquisition advisory capabilities across public market takeovers and defence

- Strategic advisory relating to the assessment of divestitures and joint ventures

- Target/acquirer identification, review and approach strategy

- Transaction structuring, negotiation, due diligence, risk analysis valuation, financing and execution

- Defence preparation, offer analysis, response strategy and corporate valuation

- White knight search and engagement

The most comprehensive and best-resourced emerging company coverage in the Australian market.

Complete investor coverage encompassing institutional investors, family offices, High Net Worth individuals and retail investors, across Australia and internationally.

Multi-channel after-market support:

- Market commentary & trade activity analysis

- Domestic & international roadshows

- Investor conferences & media relations

- Presentations to the Ord Minnett network

Proprietary research from our experienced team of equity research analysts and investment strategists, supplemented by access to global institutional research – delivering unparalleled breadth and depth.

Ord Minnett's equity research product offering was ranked the #1 Emerging Company Focused Broker and #2 Overall (including global investment banks) for Small Cap Priority Accounts in 2019.*

Research Platform Overview

- Ord Minnett's proprietary research from our in-house team of research analysts and investment strategists are renowned for their coverage of emerging ASX-listed stocks

- Ord Minnett’s equity research product offering was ranked as the #1 Emerging Company Focused Broker and #2 overall (including global investment banks) for Small Cap Priority Accounts in 2019

- Ord Minnett was also ranked as the Most Improved (2017 to 2019) for All Investors Small Cap Stock Research

- Coverage of >80 emerging companies across a range of sectors, including technology, diversified financials, travel and consumer discretionary, resources, property and professional services

- Ord Minnett’s Research ‘black out’ period is 14 days (vs. 45 days for most US-operating investment banks)

*Peter Lee Research Ranking Survey, 2019

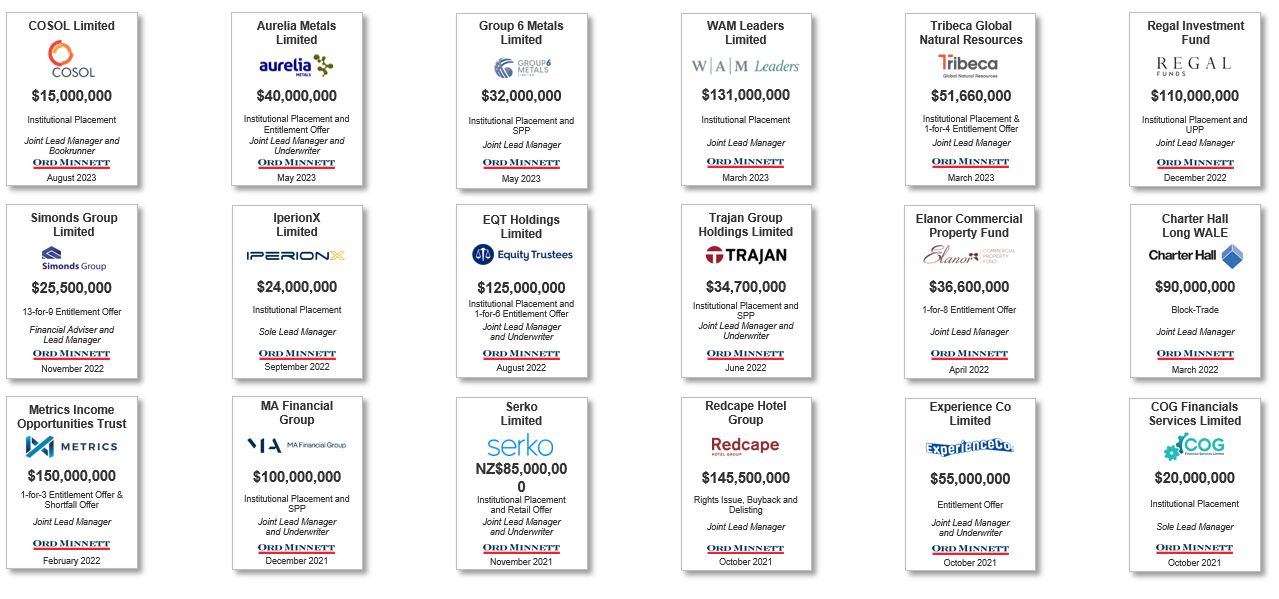

Deal Credentials

Leadership Team

Ross Baildon - Managing Director & Head of Corporate Finance

Ross has over twenty five years' investment banking experience covering capital markets, equity sales, sales trading & trading. Ross has been instrumental in delivering and executing over 350 successful capital market transactions including pre IPO, privatisations, IPOs, follow-ons and equity-linked across all Asia Pacific markets. His previous roles include Managing Director and Head of ECM Syndicate Asia for UBS and Credit Suisse.

P: +61 7 3214 5509

Get in Touch

Start a Conversation with Ord Minnett Corporate Finance today.

'Best-in-Class advice to clients'